Nvidia's AI-Powered Ascent: From Gaming Giant to $3 Trillion AI Juggernaut

Uncover Nvidia's transformation from gaming company to $3 trillion AI giant. Explore the tech innovations and market forces propelling its unprecedented growth in the AI era.

In the rapidly evolving landscape of technology, few stories are as remarkable as Nvidia’s transformation from a gaming graphics company to a dominant force in artificial intelligence. This journey, culminating in a staggering $3 trillion valuation, is intricately tied to the AI revolution. Let’s delve deep into the technical and economic factors that have propelled Nvidia to these unprecedented heights.

The Technical Foundation: Why Nvidia GPUs Excel at AI

1. Parallel Processing Architecture

At the core of Nvidia’s success in AI is the fundamental architecture of their Graphics Processing Units (GPUs). Originally designed for rendering complex 3D graphics in video games, GPUs are built for parallel processing – the ability to perform multiple computations simultaneously. This architecture turns out to be ideally suited for AI workloads, particularly in deep learning.

Deep learning algorithms, which form the backbone of many modern AI systems, rely heavily on matrix multiplications and vector operations. These operations can be parallelized, meaning they can be broken down into smaller tasks that can be processed simultaneously. While traditional Central Processing Units (CPUs) excel at sequential processing, they struggle with these parallel workloads. GPUs, on the other hand, can handle these operations with remarkable efficiency.

To put this into perspective, a modern Nvidia GPU can contain thousands of small, efficient cores designed for parallel processing, compared to a CPU which might have 8 or 16 more complex cores. This allows GPUs to perform the massive number of calculations required for training and running AI models at speeds orders of magnitude faster than CPUs.

2. Tensor Cores: Specialized AI Hardware

Recognizing the growing importance of AI, Nvidia introduced Tensor Cores with their Volta architecture in 2017. Tensor Cores are specialized processing units designed specifically for deep learning operations. These cores can perform mixed-precision matrix multiply and accumulate calculations in a single operation, which are crucial for AI workloads.

The introduction of Tensor Cores marked a significant leap in AI processing capabilities. For instance, the Nvidia A100 GPU, powered by third-generation Tensor Cores, can deliver up to 5 petaflops of AI performance. This level of performance has made tasks that were once computationally prohibitive, such as training large language models like GPT-3, feasible.

Each successive generation of Nvidia GPUs has seen improvements in Tensor Core technology. The latest Hopper architecture, featuring fourth-generation Tensor Cores, offers even higher performance and better energy efficiency for AI workloads.

3. CUDA: The Software Advantage

While hardware capabilities are crucial, Nvidia’s dominance in AI is also due to its software ecosystem, particularly CUDA (Compute Unified Device Architecture). CUDA is a parallel computing platform and programming model developed by Nvidia that allows software developers to use Nvidia GPUs for general-purpose processing.

CUDA provides a comprehensive set of tools, libraries, and APIs that make it significantly easier for researchers and developers to leverage GPU power for AI applications. This includes libraries like cuDNN (CUDA Deep Neural Network library), which provides highly optimized implementations for common deep learning operations.

The widespread adoption of CUDA has created a powerful network effect. As more developers use CUDA, more AI frameworks and libraries are optimized for Nvidia hardware, which in turn attracts more developers to the platform. This ecosystem has become a significant moat for Nvidia, making it challenging for competitors to gain a foothold in the AI hardware market.

The AI Boom: Economic Factors Driving Nvidia’s Growth

1. Exponential Growth in AI Investments

The global investment in AI has seen explosive growth over the past decade. According to data from Stanford University’s AI Index Report, global private investment in AI reached $91.5 billion in 2021, more than double the total from 2020. This massive influx of capital into AI research and development has directly translated into increased demand for Nvidia’s products.

As companies and research institutions pour resources into developing and deploying AI solutions, they require powerful hardware to train and run their models. Nvidia, with its AI-optimized GPUs and robust software ecosystem, has been perfectly positioned to meet this demand.

2. The Rise of Cloud Computing and AI-as-a-Service

The growth of cloud computing giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud has been a significant boon for Nvidia. These providers offer AI-as-a-Service platforms, allowing companies to access powerful AI capabilities without having to invest in expensive hardware themselves.

To power these services, cloud providers have become major customers of Nvidia’s data center GPUs. For instance, Amazon’s AWS offers instances powered by Nvidia GPUs for machine learning workloads, while Google Cloud uses Nvidia GPUs to power its Tensor Processing Units (TPUs).

This trend has opened up a massive new market for Nvidia. In fiscal year 2024, Nvidia’s data center revenue, which includes sales of GPUs for cloud and AI applications, reached $47.51 billion, a 217% increase from the previous year. This segment has now surpassed gaming as Nvidia’s largest source of revenue.

3. The AI Arms Race

As AI capabilities advance, companies across various industries are rushing to implement AI solutions to stay competitive. This has created a sort of “AI arms race,” where businesses feel compelled to invest in AI technology or risk falling behind.

This race extends beyond the tech industry. Financial services firms are using AI for fraud detection and algorithmic trading. Healthcare companies are leveraging AI for drug discovery and medical imaging analysis. Automotive companies are investing heavily in AI for autonomous driving technologies. All of these applications require powerful AI hardware, driving demand for Nvidia’s products.

4. High Barriers to Entry

Developing competitive AI chips requires enormous R&D investments and specialized expertise. Nvidia’s early mover advantage and continued innovation have created high barriers to entry in this market.

Nvidia has invested billions of dollars in R&D over the years to develop its GPU technology and AI software ecosystem. In fiscal year 2024 alone, the company spent $8.7 billion on R&D. This level of investment, combined with the network effects of its software ecosystem, makes it challenging for new entrants to compete effectively.

While competitors like AMD and Intel are making efforts to catch up, and cloud giants like Google and Amazon are developing their own custom AI chips, Nvidia’s lead in both hardware performance and software ecosystem remains significant.

Nvidia’s AI Product Portfolio

Nvidia’s success in AI is not just due to a single product, but a comprehensive portfolio of hardware and software solutions designed for various AI applications. Let’s break down some key components of this portfolio:

1. Data Center GPUs

Nvidia’s data center GPUs, such as the A100 and H100, are the workhorses of modern AI infrastructure. These GPUs are designed for high-performance computing and AI workloads in data centers and supercomputers.

The H100, based on the Hopper architecture, represents the current pinnacle of Nvidia’s GPU technology. It can deliver up to 6x the performance of its predecessor, the A100, for AI training workloads. This level of performance allows researchers to train larger, more complex AI models in less time, accelerating the pace of AI innovation.

2. DGX Systems

Nvidia’s DGX systems are purpose-built AI supercomputers that integrate multiple GPUs with high-speed interconnects and optimized software. The latest DGX H100 system, for instance, combines eight H100 GPUs with Nvidia’s NVLink and NVSwitch technologies to provide massive AI computing power.

These systems are designed for organizations that need to train and deploy large-scale AI models. They’ve been adopted by research institutions, large enterprises, and even nation-states investing in AI capabilities.

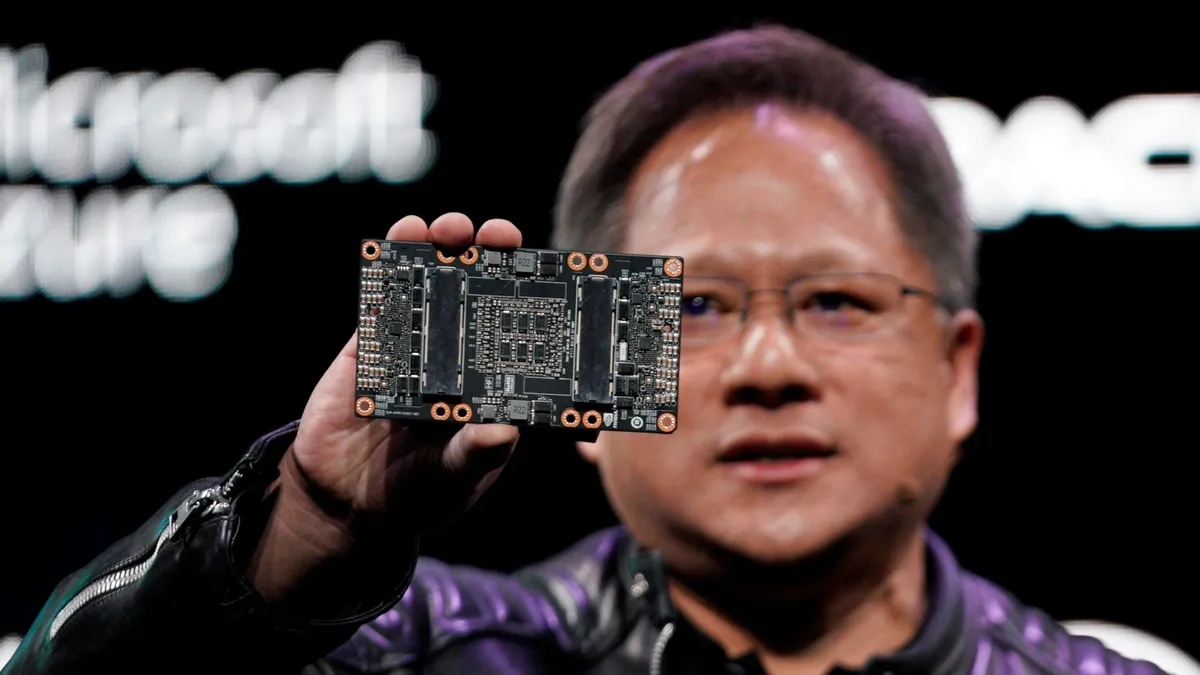

3. Jetson Platform

For edge AI applications – AI that runs on devices in the field rather than in data centers – Nvidia offers the Jetson platform. These compact, energy-efficient modules bring AI capabilities to embedded systems and IoT devices, enabling applications like autonomous machines, intelligent video analytics, and more.

The Jetson platform extends Nvidia’s reach beyond data centers, allowing the company to capture value from the growing trend of edge AI.

4. CUDA-X AI and NGC

On the software side, Nvidia provides CUDA-X AI, a collection of libraries, tools, and technologies that accelerate AI workflows. This includes libraries for deep learning (cuDNN), computer vision (NPP), natural language processing (NeMo), and more.

The NGC (Nvidia GPU Cloud) catalog offers a comprehensive set of GPU-optimized AI software, including popular frameworks like TensorFlow and PyTorch. This makes it easier for developers to deploy AI applications on Nvidia hardware, further strengthening the company’s ecosystem.

The Economics of Nvidia’s AI-Driven Growth

The impact of AI on Nvidia’s financial performance has been nothing short of extraordinary. Let’s break down some key financial metrics:

1. Revenue Growth

Nvidia’s revenue has seen explosive growth, largely driven by its data center segment, which includes AI-related sales. In fiscal year 2024, Nvidia reported total revenue of $60.92 billion, a staggering 126% increase from the previous year. The data center segment alone accounted for $47.51 billion of this, representing a 217% year-over-year growth.

This growth rate is unprecedented for a company of Nvidia’s size and speaks to the enormous demand for AI hardware and software.

2. Gross Margin Expansion

As demand for Nvidia’s AI chips has surged, the company has been able to command premium prices, leading to expanding gross margins. In Q4 FY2024, Nvidia reported a gross margin of 76.0%, up from 63.3% in the same quarter of the previous year.

This margin expansion indicates that Nvidia has significant pricing power in the AI chip market, likely due to the performance advantages of its products and the strength of its software ecosystem.

3. Market Capitalization

Nvidia’s market capitalization has skyrocketed, reaching the $3 trillion milestone in 2024. This represents an increase of over 15,000% from its value a decade ago, vastly outperforming the broader stock market and even other tech giants.

To put this in perspective, Nvidia’s market cap is now larger than the GDP of major economies like the United Kingdom or India. This valuation reflects investors’ belief in the long-term potential of AI and Nvidia’s position as a key enabler of this technology.

Future Prospects and Challenges

While Nvidia’s growth story has been remarkable, the company faces both exciting opportunities and significant challenges as it looks to the future.

1. Continued AI Advancements

As AI continues to evolve, new applications and use cases are constantly emerging. Areas like generative AI, which powers systems like ChatGPT, are driving demand for even more powerful GPU clusters. Nvidia is well-positioned to capitalize on these trends with its ongoing R&D efforts and new product developments.

The company is also exploring emerging fields like quantum computing, which could open up new avenues for growth in the future.

2. Expansion into New Markets

Nvidia is leveraging its AI expertise to expand into new markets. For instance, its $50 million investment in robotics company Figure AI signals an interest in the growing field of humanoid robots. The company is also heavily involved in the development of autonomous vehicle technology through its DRIVE platform.

These expansions could provide new growth vectors for Nvidia as the AI market matures.

3. Competition and Regulatory Challenges

Despite its current dominance, Nvidia faces increasing competition. Companies like AMD and Intel are ramping up their efforts in the AI chip market, while cloud giants like Google and Amazon are developing their own custom AI chips.

Additionally, Nvidia may face regulatory scrutiny due to its market dominance. The company’s attempted acquisition of Arm, which was ultimately abandoned due to regulatory concerns, highlights the potential challenges Nvidia may face as it continues to grow.

4. Geopolitical Factors

The ongoing technology rivalry between the United States and China poses both opportunities and challenges for Nvidia. While restrictions on chip exports to China could impact sales, they may also solidify Nvidia’s position in other markets.

Conclusion

Nvidia’s transformation from a gaming graphics company to an AI powerhouse is a testament to the company’s vision, adaptability, and technical excellence. The confluence of Nvidia’s GPU technology, the explosion of AI applications, and the massive investments flowing into the AI sector have created a perfect storm that has propelled Nvidia to unprecedented heights.

As we look to the future, AI’s importance is only set to grow, with applications expanding into nearly every industry. Nvidia’s deep entrenchment in the AI ecosystem, from hardware to software, positions it well to continue benefiting from this trend. However, the company will need to navigate challenges such as increasing competition, potential regulatory hurdles, and geopolitical tensions.

Nvidia’s journey illustrates the transformative power of identifying and capitalizing on emerging technological trends. As AI continues to reshape our world, Nvidia’s story will likely remain intertwined with the broader narrative of AI’s impact on society and the global economy. The next chapter of this remarkable company’s story is sure to be as exciting and impactful as its rise to AI dominance.